2022 Board Performance Assessment Benchmarks: Three Takeaways for Boards

The days of check-the-box board performance assessments are over. To be sure, self-evaluations are still required for public company boards and a best practice for all, but boards have figured out that a well-orchestrated assessment provides valuable insights to guide the board and the process is worth taking seriously. High-performing boards want to know exactly what is and isn’t working and to explore pertinent issues. Still, boards find that even a thoughtful assessment can be hard to interpret without context, so next-gen board performance assessments now include a critical new element: Benchmarking.

Benchmarking against peers with objective data is the best way to fully understand performance data. Measuring a board’s performance in this way is especially valuable now as governance practices are evolving and boards seek a better understanding of how and when to embrace new responsibilities or approach areas of potential concern.

Boardspan is excited to share the latest data: our 2022 Board Performance Assessment Benchmarks.

What do board performance benchmarks measure?

Boardspan’s Board Performance Assessment evaluates a board’s strength of execution in 55 relevant areas of responsibility, across nine categories of governance best practices:

The 2022 Board Performance Assessment Benchmarking data represents the views of boards nationwide across all sectors, collected and analyzed by Boardspan. Based on a top score of 5, data indicates areas where boards think they are doing well and identifies challenges they face. What do this year’s benchmarks reveal?

First, let's do the numbers

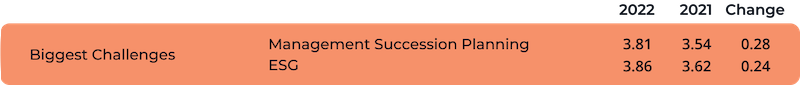

Challenges

Management Succession Planning and ESG top the list of areas where boards would like to perform better, even as results show that boards have made progress in both of these topics since 2021.

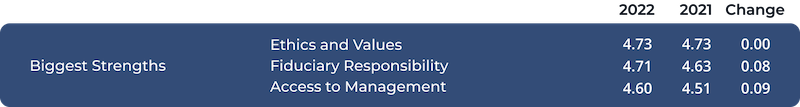

Strengths

Boards express confidence in their performance around Ethics and Values, Fiduciary Responsibilities, and Access to Management/Access to Board Members. In these three areas, all critical to high-performing boards, boards scored themselves higher than in any other topic areas.

Changes

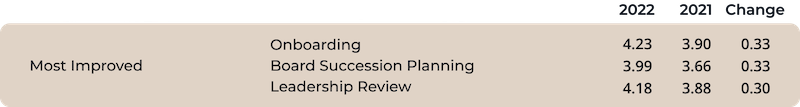

Boards also show improved confidence in their performance in Board Succession Planning, Leadership Review and Long-Term Goals.

What does all this mean? Our top takeaways from the data

Takeaway #1: Succession plans matter right now

“Succession” isn’t just an Emmy-winning television series. It’s something that keeps boards up at night: If something shakes up the top of the organization, is there a solid plan for what happens next? And recently, there’s been a whole lot of shaking going on. During the COVID crisis, there were relatively few leadership changes, while unusual circumstances masked some performance issues. That’s changing now. Executive transitions are on the rise, and the current economic situation could spur more re-evaluations and executive turnover. All of which means succession planning is top of mind and boards have a sense of urgency around it.

While the 2022 Benchmark data shows that boards don’t have a high degree of confidence in the current state of management succession planning, they are invested in changing that and recognize that this is an area that deserves significant attention.

Takeaway #2: Supporting and developing current CEOs is also an opportunity for growth

Leadership oversight is among the board’s most important jobs and has two significant parts: One is ensuring stability and a solid future by being well prepared for a transition (as discussed above vis a vis Management Succession Planning). The other is developing a good understanding of the CEO’s performance and providing them with valuable feedback: where are they especially strong and where might they benefit from guidance, mentorship, or other forms of support.

While most boards recognize the value of assessing CEO performance in an objective way that offers clear, honest, constructive feedback, not all have made it a priority. Given the relative ease with which an effective review can help identify how best to develop a leader’s talents—or uncover potential problems before they become troublesome—it’s somewhat surprising that all boards haven’t made them routine. We expect, however, that many more boards will commit to providing a thoughtful leadership review as they recognize they’ve been missing out on one of their most potent tools for ensuring an organization’s ongoing success.

Takeaway #3: ESG is a moving target and will remain so

Boards continue to be challenged by ESG. While they face scrutiny from proxy advisors (such as ISS’s Environmental & Social Quality Score), shareholder activism, and a significant SEC interest in ESG disclosures, there is no roadmap to getting ESG right. Even pinpointing which aspects of ESG are relevant to an organization can be challenging, given that everything from climate-related concerns to gender pay equity to board diversity and much, much more can fall under the ESG umbrella. Plus, expectations for ESG are relatively new, still evolving, and lack clear definition and structure. All of this has made it hard for boards to map out a clear strategy to succeed in this area.

While ESG will eventually become better defined, boards know they need to make progress now. We wouldn’t be surprised to see the benchmark score improve next year as boards start identifying those aspects of ESG most relevant to their business, whether based on regulatory concerns, constituent demands, or their commitment to uphold values relevant to the organization’s vision and mission, and set strategies to make progress. The first step is always the hardest, but many boards show interest in getting moving on ESG.

How Boardspan benchmarks benefit our clients

Boardspan clients who take our Board Performance Assessment receive the benchmark scores alongside their own results so they can compare their performance with that of other top boards. The ability to gauge results against a group of peers is always valuable, but even more so for boards, whose work and challenges generally take place in a cone of silence. Given the confidential nature of board work, it’s rare to get a window into the experience of others.

Boardspan is the only board governance solution that offers this type of objective benchmark with which boards can measure their performance relative to peers. By being a part of the Board Performance Assessment, boards can use this valuable information to:

- Identify strengths and weaknesses in their board by knowing what good looks like

- Set goals and performance expectations measured against objective data

- Monitor performance from year to year, both against their own numbers and the overall benchmark

- Manage change more effectively

If you’re interested in learning more about how to improve board performance and how to plan for management succession, leadership review, the challenges of ESG, and more, click here.