The 3 Core Responsibilities of the Board of Directors

Boards are tasked with a lot, and to accomplish their objectives members need a common understanding of their role and responsibilities. Surprisingly, even among experienced board members there can be different ideas about what the job entails. Just ensuring that everyone is on the same page can go a long way toward overall board effectiveness.

There are three core areas of responsibility that lie with the board.

1. Perform fiduciary duties

Fiduciary responsibilities often center around board oversight and other performance-related metrics. However, fiduciary responsibilities extend beyond the numbers and are the underpinning of most board work.

Board members have:

A duty of care, to carry out their responsibilities with diligence, thoughtfulness, and skills in a prudent manner. Decisions should be well informed, based on currently known facts and opinions. Board-level decisions should not be delegated to others, including to management or committees.

A duty of loyalty, to act in good faith and put the interests of the organization first, not to benefit any other party or themselves. Nor should they act out of expedience. Any potential conflicts of interest should always be disclosed.

A duty of obedience, to ensure that the organization is operating according to its stated purpose, and in compliance with the law.

2. Ensure appropriate leadership

Unless an organization is in crisis mode, the board shouldn’t take on any management responsibilities. Therefore, it’s important that the board ensures that there is a strong CEO or Executive Director in place and that person, in turn, is building a strong management team around them.

How does a board ensure that this is the case? It’s the board’s responsibility to provide the following support:

Leadership oversight

At a high level, effective leadership oversight begins with a respectful, trusting relationship between the board and CEO, with transparency at its core. It requires an appropriate flow of information and communication between the board and management and having reasonable checks and balances in place.

The board will want visibility into and regular management updates around such topics as:

- Progress on the core strategies in place, including milestone check-ins

- Financial topics, such as timely and accurate results and audit-related matters

- Compliance with key regulatory requirements

- Risk management, from cybersecurity to safety to customer dependencies

- Workplace culture, including standards for behavior and mechanisms for reporting misconduct.

- Environment Social Governance (ESG) issues pertinent to the business

Some of these areas of oversight may be handled by committees, while other topics are the purview of the whole board. The general maxim for board oversight is “Trust Yet Verify.” No CEO should feel threatened or insulted by these inquiries. Rigorous oversight is just the board doing its job.

CEO review

A periodic CEO review, usually annually, isn’t just one of the most helpful contributions that a board can make to the well-being of the business: it’s a core responsibility. A thorough and balanced review gives the CEO feedback that acknowledges their accomplishments. It’s a constructive means to help them continue to grow in their role. And it provides the board’s compensation committee or board leadership a basis for regular compensation discussions with objective data in hand.

Whenever possible, 360 reviews are the most effective. Boards can consider the whole board’s aggregate feedback, that of the CEO via a self-assessment, and input from the CEO’s direct reports.

Succession planning

Management succession planning is a critical board responsibility. Even the strongest of leadership teams can experience unexpected situations that require new talent at the top. The board needs to know where it is going to look to find leadership, whether internally or externally. The best boards are always fully prepared for succession planning.

There are two types of succession planning that a board should think about:

Planned succession

Planned succession allows a board to prepare and be proactive about how they would like to see a leadership handoff.

In planned succession, boards can:

- Establish a timeline

- Identify internal candidates and take the opportunity to groom existing employees and fill gaps in leadership

- Identify external candidates who might be the best choice

- Outline a process to screen, assess, and cultivate any candidates for succession

Unplanned succession

Boards always want to plan for succession. But unplanned succession is commonplace. It’s wise for boards to be ready for either planned or unplanned succession.

For unplanned succession that needs to happen in the short term, boards can:

- Establish an “emergency” plan for interim leadership

- Firm up a process for board leadership to enact unplanned succession

- Find external advisors who may be able to assist

- Review internal candidates for both interim and permanent spots

- Keep the CEO position spec updated semi-annually

Understandably, succession planning can make some CEOs uncomfortable. Boards should enlist their participation in a non-threatening way. This succession planning can also serve as a role model for the CEO, since they should be doing a similar succession planning exercise for their C-suite.

3. Be dedicated and available to the company

While board members aren’t involved in day-to-day activities and may only come together a few times a year, the role requires more than sporadic engagement. For a board to be effective and well run, it needs all its members to be dedicated to the organization’s success, and to commit the time and attention necessary to fulfill their duties. Of course, this means attending regular meetings and being well prepared. But it also extends to other engagement that organizations can reasonably expect of a board member, for example:

- Taking calls from management and providing guidance when asked

- Leveraging connections when they can benefit the company

- Staying up to date on developments that might affect the organization

- And in the case of many nonprofit boards, fundraising

Well run boards establish clear expectations around attendance, preparation, and committee participation, as well as other areas where board members are expected to lend their skills, expertise, and networking capabilities. Some boards formally document their responsibilities while others perpetuate them through strong cultures. Because every board is different, it behooves all boards to be explicit about expectations.

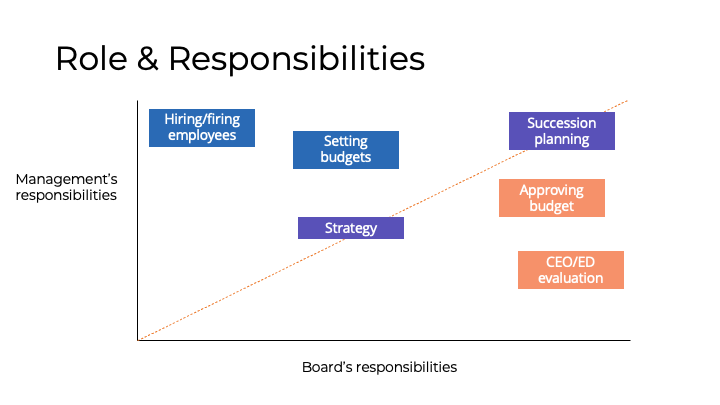

The board and management: Division of responsibilities

The level of board involvement in an organization usually changes over time with younger, earlier stage organizations demanding more board participation and more mature organizations benefiting from boards that focus solely on oversight and strategic guidance. It’s valuable for the board and management to be crystal clear about who is responsible for what, and to update this understanding when organizational changes demand a new approach.

Without a doubt management’s priority is running the organization. That includes hiring and firing employees, setting budgets, overseeing operations. The board provides oversight of these activities, such as approving the budget and evaluating CEO and ED performance.

Responsibilities overlap in a few critical areas. Management and the board work more closely on setting strategy for the organization. And good succession planning requires input from both the board and the CEO. But in all areas, each role is most successful when there is communication, two-way conversation, honesty, and trust.

What does it take to be a high-performing board?

A good foundation is the basis for high performance down the road. Learn more about what it takes to not only fulfill these core responsibilities but go beyond the basics to elevate board and company performance. Download our report, The Governance Curve: A New Way to Think About Board Success.